The Ghana Stock Exchange (GSE) could end the year with as much as an 18 percent return on account of non-financial stocks’ performance, databank has stated in a revision of its market outlook for the year.

At beginning of the year, the financial asset manager pegged growth at around 12 percent – a sharp turn from the 13 percent drop recorded at the close of 2022.

However, in its latest quarterly outlook note dubbed ‘Beyond the Trough: Stocks Remain in the Spotlight as a Glimpse of Economic Normalcy Emerges’, it noted that the 42023 return will be higher than earlier projected.

“The stock market’s stirring growth this year has been driven by the demand for non-financial stocks. We expect the trend to continue in second-half of the year, although there may be some blips of profit-taking as investors attempt to secure their gains. Accordingly, we adjust our year-end forecast for the GSE CI to 15 percent (±300bps).

“Hence, we expect income investors to maintain a favourable posture toward reliable, high dividend-paying and defensive stocks like Benso Oil, MTN and TotalEnergies, which offer steady earnings and returns even during economic downturns,” Databank said.

It meanwhile cautioned that the second round of the Domestic Debt Exchange Programme (DDEP) had heightened concerns about financial stocks: “It is worth noting that the announcement of the second round of DDEP has intensified investors’ concerns about the impact on financials”.

Sectorial analysis

In the agricultural sector, Benso Oil’s outstanding performance is expected to sustain demand for the stock. Databank foresees continued positive earnings growth and favourable dividends due to the current high global market prices for crude palm oil and the weakened local currency. The edible oil producer has already achieved an 84 percent year-to-date return – the highest on the GSE.

MTN, given its stellar performance thus far this year, is predicted to see a further rise in its share price. With its large market cap, high liquidity and consistently solid financial results, MTN remains a top choice for investors, Databank noted.

Furthermore, the telecommunication behemoth’s investments in network infrastructure and innovative offerings have contributed to its ability to generate solid earnings and provide generous dividends even during times of macroeconomic uncertainty.

TotalEnergies, on the oil marketing counter, is also projected to enjoy a positive market view, benefitting from the company’s stable earnings and consistent dividend yield.

“We remain bullish for TotalEnergies as we anticipate the stock to continue enjoying a positive market view, benefitting from the company’s stable earnings and consistent dividend yield,” the report stated.

However, the demand for banking stocks remains weak due to the negative impact of DDEP on earnings growth and the suspension of dividends by the Bank of Ghana (BoG) until further notice.

Already, investors are concerned about potential losses from the ongoing restructuring of USD-denominated domestic bonds and Cocoa bills which align with IMF conditionality. Databank anticipates industry players to implement measures that mitigate risk, protect the capital base, and improve earnings generation capacity and operational resilience.

Indices

In July the GSE Composite Index (GSE-CI) continued its positive momentum, surging by 168.74 points – resulting in a year-to-date return of 21.30 percent. The GSE Financial Stock Index (GSE-FSI) also ended higher than the previous month, reducing its negative year-to-date return to 16.44 percent.

Regarding trading activities, both volume and value traded saw significant increases; rising by 669.42 percent and 24.25 percent respectively compared to the previous month. This growth was fuelled by strong performances from listed companies in their half-year results and a bullish sentiment among investors.

Although performance improved compared to the previous month, the year-on-year results remain relatively subdued. The top-five price gainers for the month were Guinness Ghana (32.08 percent), Societe Generale (23.73 percent), MTN (8.33 percent), CALBank (6.67 percent), and TotalEnergies (5.43 percent).

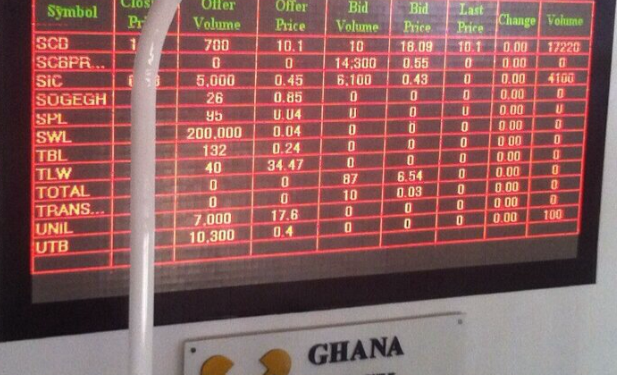

At the close of trading last week, 179,136 shares corresponding to a market value of GH¢262,234 were traded on the Ghana Stock Exchange.

In terms of performance, the benchmark GSE-CI saw a modest increase of 4.57 points (0.15 percent) to close at 3,127.43. This represents a 1-week gain of 6.64 percent, a 4-week gain of 10.89 percent and an overall year-to-date gain of 27.97 percent.

The GSE-FSI also recorded modest growth, increasing by 0.5 percent to reach 1,723.78 points. However, it still experienced a 1-week gain of 0.5 percent, a 4-week gain of 2.1 percent and a year-to-date loss of 16.02 percent.